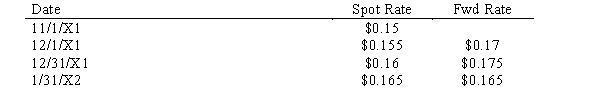

On November 1, 20X1, a U.S. company sold merchandise to a foreign firm for 100,000 FCs with payment to be made on January 31, 20X2, in FCs. To hedge against fluctuations in exchange rates, the firm entered into a forward exchange contract on December 1, 20X1 to sell 100,000 FCs on January 31, 20X2. The U.S. firm has a December 31 year end for accounting purposes. The following exchange rates may apply:

Discount rate = 10%

Discount rate = 10%

Required:

Make all the necessary journal entries for the U.S. firm relative to these events occurring between November 1, 20X1, and January 31, 20X2.

Correct Answer:

Verified

Q47: Bulldog Enterprise, a U.S. firm, agreed on

Q48: On November 1, 20X1, a U.S. company

Q49: Describe the disclosures required by the FASB

Q50: On 7/1, a company forecasts the

Q51: On November 1, 20X2, a calendar-year investor

Q53: Explain how the risks differ for holders

Q54: Zerlie's Imports purchased automotive parts from a

Q55: On November 1, 20X8 Desket, Inc. a

Q56: Wolters Corporation is a U.S. corporation that

Q57: Lion Corporation, a U.S. firm, entered into

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents