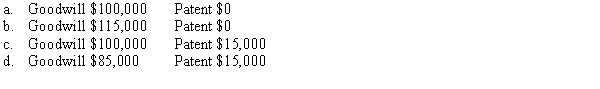

Orbit Inc. purchased Planet Co. in 20X3. At that time an existing patent was not recorded as a separately identified intangible asset. At the end of fiscal year 20X4, the patent is valued at $15,000, and goodwill has a book value of $100,000. How should intangible assets be reported at the beginning of fiscal year 20X5?

Correct Answer:

Verified

Q2: A tax advantage of business combination can

Q15: Separately identified intangible assets are accounted for

Q17: An economic advantage of a business combination

Q18: Internet Corporation is considering the acquisition

Q19: In performing impairment test for goodwill,

Q21: The Chan Corporation purchased the net assets

Q22: On January 1, 20X5, Brown Inc.

Q23: On January 1, 20X5, Zebb and Nottle

Q24: On January 1, 20X1, Honey Bee Corporation

Q45: While acquisitions are often friendly, there are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents