Cost,Volume,Profit Analysis

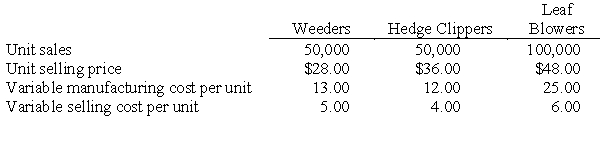

Kalifo Company manufactures a line of electric garden tools that are sold in general hardware stores.The company's controller,Sylvia Harlow,has just received the sales forecast for the coming year for Kalifo's three products:weeders,hedge clippers,and leaf blowers.Kalifo has experienced considerable variations in sales volumes and variable costs over the past two years,and Harlow believes the forecast should be carefully evaluated from a cost-volume-profit viewpoint.The preliminary budget information for 1996 is presented below.  For 1996,Kalifo's fixed factory overhead is budgeted at $2 million,and the company's fixed selling and administrative expenses are forecast to be $600,000.Kalifo has a tax rate of 40 percent.

For 1996,Kalifo's fixed factory overhead is budgeted at $2 million,and the company's fixed selling and administrative expenses are forecast to be $600,000.Kalifo has a tax rate of 40 percent.

Required:

a.Determine Kalifo Co.'s budgeted net income for 1996.

b.Assuming that the sales mix remains as budgeted,determine how many units of each product Kalifo must sell in order to break even in 1996.

c.Determine the total dollar sales Kalifo must sell in 1996 in order to earn an after-tax net income of $450,000.

d.After preparing the original estimates,Kalifo determines that its variable manufacturing cost of leaf blowers will increase 20 percent and the variable selling cost of hedge clippers can be expected to increase $1 per unit.However,Kalifo has decided not to change the selling price of either product.In addition,Kalifo learns that its leaf blower is perceived as the best value on the market,and it can expect to sell three times as many leaf blowers as any other product.Under these circumstances,determine how many units of each product Kalifo will have to sell to break even in 1996.

e.Explain the limitations of cost-volume-profit analysis that Sylvia Harlow should consider when evaluating Kalifo's 1996 budget.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Cost,Volume,Profit Analysis

With the possibility of the US

Q3: Cost,Volume,Profit Analysis

Leslie Mittelberg is considering the wholesaling

Q4: Cost-volume-profit of a Make/buy Decision

Elly Industries is

Q5: Make Buy

A company has needs 10,000 units

Q6: Make/Buy and the Opportunity Cost of Freed

Q8: The Elements of Cost Volume Profit

The M

Q9: Breakeven and Cost-Volume-Profit with Taxes

DisKing Company is

Q10: Fixed and Variable Costs

The university athletic department

Q11: Multiple Product Cost Volume Profit

A company sells

Q12: Opportunity Cost of Attracting Industry

The Itagi Computer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents