Make/Buy and the Opportunity Cost of Freed Capacity

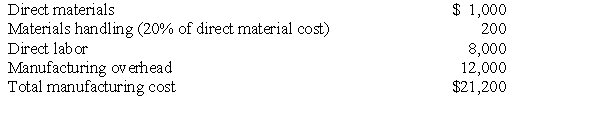

Leland Manufacturing uses 10 units of part KJ37 each month in the production of radar equipment.The cost to manufacture one unit of KJ37 is presented in the accompanying table.  Materials handling represents the direct variable costs of the receiving department and is applied to direct materials and purchased components on the basis of their cost.This is a separate charge in addition to manufacturing overhead.Leland's annual manufacturing overhead budget is one-third variable and two-third fixed.Scott Supply,one of Leland's reliable vendors,has offered to supply part KJ37 at a unit price of $15,000.The fixed cost of producing KJ37 is the cost of a special piece of testing equipment that ensures the quality of each part manufactured.This testing equipment is under a long-term,noncancelable lease.If Leland were to purchase part KJ37,materials handling costs would not be incurred.

Materials handling represents the direct variable costs of the receiving department and is applied to direct materials and purchased components on the basis of their cost.This is a separate charge in addition to manufacturing overhead.Leland's annual manufacturing overhead budget is one-third variable and two-third fixed.Scott Supply,one of Leland's reliable vendors,has offered to supply part KJ37 at a unit price of $15,000.The fixed cost of producing KJ37 is the cost of a special piece of testing equipment that ensures the quality of each part manufactured.This testing equipment is under a long-term,noncancelable lease.If Leland were to purchase part KJ37,materials handling costs would not be incurred.

Required:

a.If Leland purchases the KJ37 units from Scott,the capacity Leland was using to manufacture these parts would be idle.Should Leland purchase the parts from Scott? Make explicit any key assumptions.

b.Assume Leland Manufacturing is able to rent all idle capacity for $25,000 per month.Should Leland purchase from Scott Supply? Make explicit any key assumptions.

c.Assume that Leland Manufacturing does not wish to commit to a rental agreement but could use idle capacity to manufacture another product that would contribute $52,000 per month.Should Leland manufacture KJ37? Make explicit any key assumptions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Fixed,Variable,and Average Costs

Midstate University is trying to

Q2: Cost,Volume,Profit Analysis

With the possibility of the US

Q3: Cost,Volume,Profit Analysis

Leslie Mittelberg is considering the wholesaling

Q4: Cost-volume-profit of a Make/buy Decision

Elly Industries is

Q5: Make Buy

A company has needs 10,000 units

Q7: Cost,Volume,Profit Analysis

Kalifo Company manufactures a line of

Q8: The Elements of Cost Volume Profit

The M

Q9: Breakeven and Cost-Volume-Profit with Taxes

DisKing Company is

Q10: Fixed and Variable Costs

The university athletic department

Q11: Multiple Product Cost Volume Profit

A company sells

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents