ROI and Residual Income

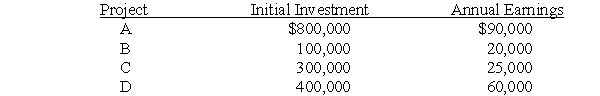

The following investment opportunities are available to an investment center manager:  Required:

Required:

a.If the investment manager is currently making a return on investment of 16 percent,which project(s)would the manager want to pursue?

b.If the cost of capital is 10 percent and the annual earnings approximate cash flows excluding finance charges,which project(s)should be chosen?

c.Suppose only one project can be chosen and the annual earnings approximate cash flows excluding finance charges.Which project should be chosen?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Performance Measures for Cost Centers

A soft drink

Q4: Jefferson Company has two divisions: Jefferson Bottles

Q5: Comparing ROA and EVA

General Motors's CFO,Michael Losh,converted

Q6: Transfer Pricing in the Presence of Divisional

Q8: Responsibility Centers

The Maple Way Golf Course is

Q10: Transfer Prices and External Sourcing

Lewis is a

Q12: The Eastern University Business School teaches some

Q14: A chair manufacturer has two divisions: framing

Q15: The Alpha Division of the Carlson Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents