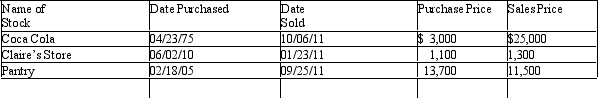

Henry sold the following stock during the year.He is in the 33 percent tax bracket for his ordinary income.How are the stocks reported on Henry's tax return?

A) $19,800 of net long-term gain taxed at zero percent and $200 short-term gain taxed at the 33 percent rate.

B) $19,800 of net long-term gain taxed at 15 percent and $200 short-term gain taxed at the 33 percent rate.

C) Net $20,000 of long-term gain taxed at 15 percent

D) Net $20,000 of long-term gain taxed at 33 percent

Correct Answer:

Verified

Q1: In December of 2011,Betty and James (married,filing

Q3: Which of the following is considered a

Q4: On December 31,2011,Harold,a sole proprietor,sold for $85,000

Q5: Ponce acquired raw land costing $60,000 as

Q6: Choose the true statement regarding like-kind exchanges..

A)A

Q7: The adjusted basis of an asset may

Q8: Patrick inherited his mother's house.The house cost

Q9: Which of the following is true about

Q10: The provisions for involuntary conversion:

A)Apply to gains

Q11: During 2007,Cody purchased an automobile for $35,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents