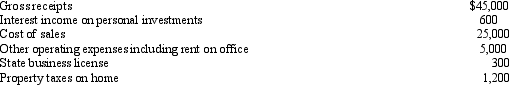

From the records of Ted,a cash basis sole proprietor,the following information was available:  What amount should Ted report as net earnings from self-employment?

What amount should Ted report as net earnings from self-employment?

A) $15,000

B) $13,500

C) $14,100

D) $14,700

E) $12,900

Correct Answer:

Verified

Q8: Wonton Foods is a partnership owned 40

Q9: The shareholders of the Cat Corporation are:

Q10: Rickie purchased a house for $300,000.$250,000 of

Q11: In 2011,Walter purchased a $75,000 milling machine

Q12: Which of the following assets is considered

Q14: Depreciation

A)Should only be used if the asset

Q15: The Exclusive Uniform partnership has a natural

Q16: Computers are depreciated over the following number

Q17: On January 1,2011,Ted purchased a small software

Q18: An asset other than an SUV or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents