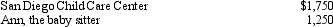

Marge and Lester file a joint tax return for 2011,with adjusted gross income of $33,000.Marge and Lester earned income of $20,000 and $12,000 respectively,during 2011.In order for Marge to be gainfully employed,they pay the following child care expenses for their 4-year-old son,Kevin:  Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

A) $0

B) $780

C) $1,250

D) $1,750

E) $3,000

Correct Answer:

Verified

Q1: Courtney and Ralph are married,file a joint

Q2: Which of the following statements is not

Q3: In regards to the alternative minimum tax

Q4: Mr.and Mrs.Darling are in the process of

Q6: Which of the following lists only community

Q7: Brenda and Mike are married and live

Q8: Mr.French had the following income and taxes:

Q9: In order to qualify for the child

Q10: Which of these statements concerning the alternative

Q11: In the case of the adoption of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents