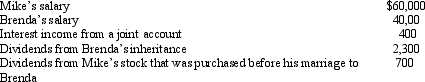

Brenda and Mike are married and live in Washington.They have the following income:  If Mike and Brenda file separate returns,how much income would Brenda report on her federal tax return?

If Mike and Brenda file separate returns,how much income would Brenda report on her federal tax return?

A) $41,700

B) $42,500

C) $51,700

D) $52,500

Correct Answer:

Verified

Q2: Which of the following statements is not

Q3: In regards to the alternative minimum tax

Q4: Mr.and Mrs.Darling are in the process of

Q5: Marge and Lester file a joint tax

Q6: Which of the following lists only community

Q8: Mr.French had the following income and taxes:

Q9: In order to qualify for the child

Q10: Which of these statements concerning the alternative

Q11: In the case of the adoption of

Q12: Leonard is a junior at ESU and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents