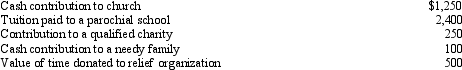

For 2011,Till and Larry had adjusted gross income of $30,000.Additional information for 2011 is as follows:  What is the maximum amount that they can use as a deduction for charitable contributions for 2011?

What is the maximum amount that they can use as a deduction for charitable contributions for 2011?

A) $1,250

B) $1,500

C) $1,600

D) $2,100

E) None of the above.

Correct Answer:

Verified

Q8: Which of the following is true of

Q9: Which of the following taxes are deductible

Q10: Which of the following expenses are deductible

Q11: Which of the following is deductible as

Q12: Janet and Andrew paid the following amounts

Q14: Which of the following miscellaneous itemized deductions

Q15: Which of the following is not deductible

Q16: Which of the following is not a

Q17: Joyce had adjusted gross income of $28,000

Q18: A difference between a Section 529 Plan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents