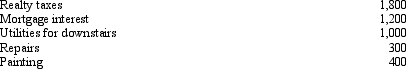

Donna owns a two-family home.She rents out the first floor and resides on the second floor.The following expenses attributable to the total building were incurred by Donna for the year ended December 31,2011:  In addition,the depreciation attributable to the first floor would be $2,000.What is the total amount of the expenses that Donna can deduct on Schedule E of Form 1040 (before any limitations) ?

In addition,the depreciation attributable to the first floor would be $2,000.What is the total amount of the expenses that Donna can deduct on Schedule E of Form 1040 (before any limitations) ?

A) $4,700

B) $6,700

C) $4,350

D) $4,850

E) None of the above

Correct Answer:

Verified

Q9: Which type of insurance is deductible as

Q10: In regards to retirement plans for self-employed

Q11: In 2011,as a single woman,Ashley's adjusted gross

Q12: In order for a plan to be

Q13: Lenore rents her vacation home for 9

Q15: Which of the following is not deductible

Q16: Which of the following is deductible as

Q17: Sharon is a lawyer (not covered by

Q18: The following is not true of Section

Q19: Sally has the following income and loss:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents