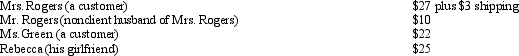

Nathan owns a small business supplies store.During 2011,Nathan gives business gifts with these costs to the following individuals:  What is the amount of Nathan's deduction for business gifts?

What is the amount of Nathan's deduction for business gifts?

A) $0

B) $50

C) $62

D) $97

E) None of the above.

Correct Answer:

Verified

Q7: If an employer chooses a per diem

Q8: Which of the following statements is true

Q9: During 2011,Trish,a self-employed healthcare consultant,travels from Los

Q10: Debbie,a pharmaceutical salesperson,works exclusively from her home.She

Q11: In year one,Dr.Drill,an accrual basis dentist,recorded $5,000

Q13: Charlene,a self-employed consultant,incurred business-related expenses in 2011

Q14: Richard operates an oriental rug store out

Q15: The following are gifts that Dr.Smile,a dentist,made

Q16: Which of the following statements regarding net

Q17: Which of the following expenses,incurred while on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents