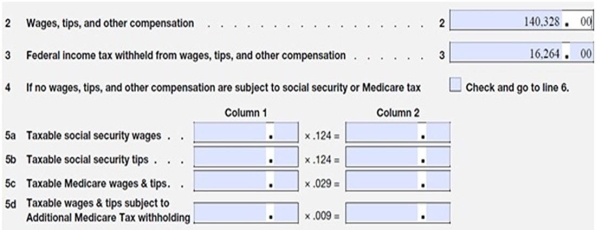

McBean Farms has the following information on their Form 941:  What amount should be entered in Column 2, Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base.)

What amount should be entered in Column 2, Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base.)

A) $17,400.67 and $4,069.51, respectively

B) $140,328.00

C) $8,700.34 and $2,034.76, respectively

D) $156,592

Correct Answer:

Verified

Q22: Cralic Company has 12 employees and operates

Q23: Cralic Company has 12 employees and operates

Q24: Daigneault Designs has the following amounts listed

Q25: Van Oot's Bicycles had $19,489 of payroll

Q28: Collin's Pool Service files a Form 944

Q30: Daigneault Designs has the following amounts listed

Q31: Lesch & Sons has been and is

Q31: Cralic Company has 12 employees and operates

Q32: Kohlmeier Industries had $87,950 of annual payroll

Q34: The time period that the IRS uses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents