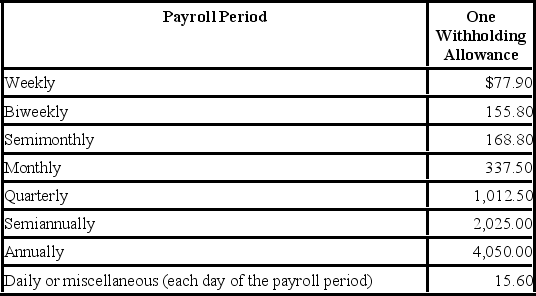

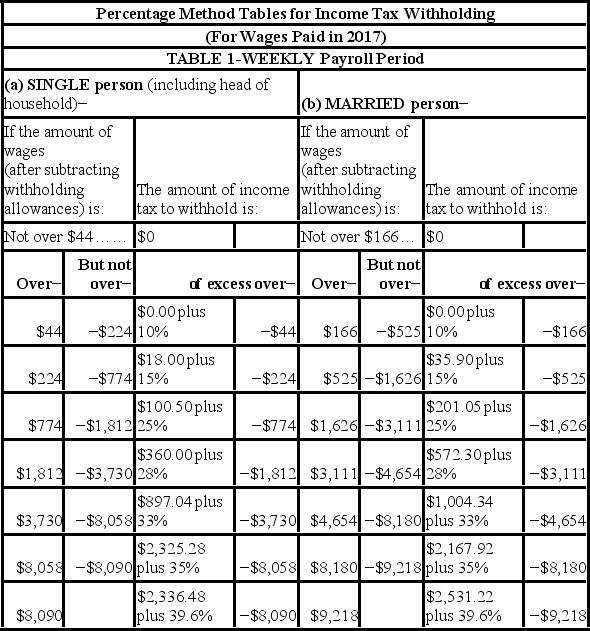

Olga earned $1,558.00 during the most recent weekly pay period. She is single with 2 withholding allowances and no pre-tax deductions. Using the percentage method, compute Olga's federal income tax for the period. (Do not round intermediate calculations. Round final answer to two decimal places.) Table 5. Percentage Method-2017 Amount for one Withholding Allowance

A) $277.93

B) $339.25

C) $257.55

D) $314.75

Correct Answer:

Verified

Q25: Andie earned $680.20 during the most recent

Q26: Max earned $1,019.55 during the most recent

Q27: Ramani earned $1,698.50 during the most recent

Q28: Warren is a married employee with six

Q29: Trish earned $1,734.90 during the most recent

Q31: Garnishments may include deductions from employee wages

Q31: Adam is a part-time employee who earned

Q33: Julian is a part-time nonexempt employee in

Q34: Steve is a full-time exempt employee at

Q39: Jeannie is an adjunct faculty at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents