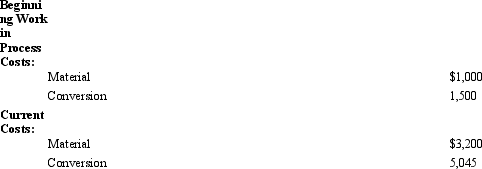

Fantastic Decorations Corporation The Fantastic Decorations Corporation makes wreaths in two departments: Forming and Decorating. Forming began the month with 500 wreaths in process that were 100 percent complete as to material and 40 percent complete as to conversion. During the month, 6,500 wreaths were started. At month end, Forming had 2,100 wreaths that were still in process that were 100 percent complete as to material and 50 percent complete as to conversion. Assume Forming uses the weighted average method of process costing. Costs in the Forming Department are as follows: The Decorating Department had 600 wreaths in process at the beginning of the month that were 80 percent complete as to material and 90 percent complete as to conversion. The department had 300 units in ending Work in Process that were 50 percent complete as to material and 75 percent complete as to conversion. Decorating uses the FIFO method of process costing, and costs associated with Decorating are:

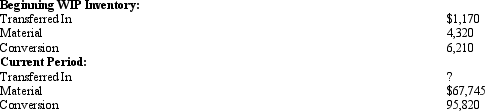

The Decorating Department had 600 wreaths in process at the beginning of the month that were 80 percent complete as to material and 90 percent complete as to conversion. The department had 300 units in ending Work in Process that were 50 percent complete as to material and 75 percent complete as to conversion. Decorating uses the FIFO method of process costing, and costs associated with Decorating are: Refer to Fantastic Decorations Corporation. Assume 8,000 units were transferred to Decorating. Compute the number of equivalent units as to costs in Decorating for the transferred-in cost component.

Refer to Fantastic Decorations Corporation. Assume 8,000 units were transferred to Decorating. Compute the number of equivalent units as to costs in Decorating for the transferred-in cost component.

A) 7,400

B) 7,700

C) 8,000

D) 8,600

Correct Answer:

Verified

Q66: When the cost of lost units must

Q68: The cost of abnormal continuous losses is

A)considered

Q91: Which of the following statements is false?

Q93: Jones Company uses a weighted average process

Q98: Roache Company uses a weighted average process

Q102: Collins Corporation Collins Corporation. has the following

Q103: Collins Corporation Collins Corporation. has the following

Q104: Brewer Corporation Brewer Corporation. has the following

Q105: Brewer Corporation Brewer Corporation. has the following

Q111: Hahn Company makes fabric-covered storage totes.The company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents