On December 30, a fire destroyed most of the accounting records of the Alcorn Division, a small one-product manufacturing division that uses standard costs and flexible budgets. All variances are written off as additions to (or deductions from) income; none are pro-rated to inventories. You have the task of reconstructing the records for the year. The general manager informs you that the accountant has been experimenting with both absorption costing and variable costing.

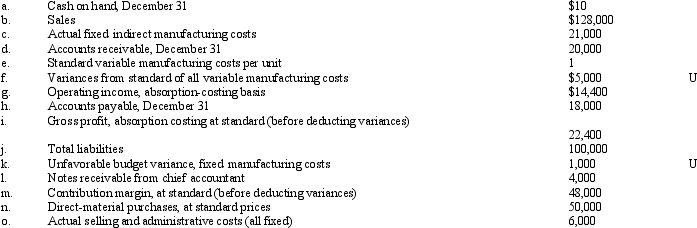

The following information is available for the current year:

Required:

Required:

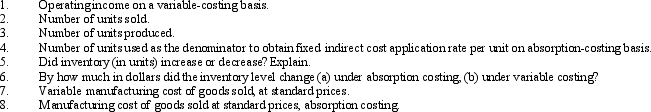

Compute the following items (ignore income tax effects).

Correct Answer:

Verified

Q181: Why do managers frequently prefer variable costing

Q183: Discuss the application of the high-low method.

Q186: How do differences in sales and production

Q190: What are the major differences between variable

Q190: Davis Corporation has the following data relating

Q195: Why is absorption costing not used for

Q196: How can a company produce both variable

Q197: Discuss underapplied and overapplied overhead and its

Q198: The facility manager of Price Corporation asked

Q200: McFatter Office Supply Company has the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents