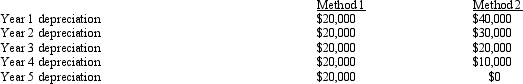

Terrell Industries is considering two alternative ways to depreciate a proposed investment. The investment has an initial cost of $100,000 and an expected five-year life. The two alternative depreciation schedules follow:  Assuming that the company faces a marginal tax rate of 40 percent and has a cost of capital of 10 percent, what is the difference between the two methods in the present value of the depreciation tax benefit? Present value tables or a financial calculator are required.

Assuming that the company faces a marginal tax rate of 40 percent and has a cost of capital of 10 percent, what is the difference between the two methods in the present value of the depreciation tax benefit? Present value tables or a financial calculator are required.

A) $7,196

B) $0

C) $2,878

D) $6,342

Correct Answer:

Verified

Q101: Income taxes are levied on

A)net cash flow.

B)income

Q115: All other factors equal,which of the following

Q123: Royal Pacific Corporation Royal Pacific Corporation is

Q126: Butler Company Butler Company is considering an

Q129: Rogers Corporation Rogers Corporation is considering an

Q132: Jackson Creations Jackson Creations is considering an

Q133: A project has an initial cost of

Q135: Majestic Cruises Corporation Majestic Cruises Corporation is

Q136: Butler Company Butler Company is considering an

Q140: A project under consideration by Hilton Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents