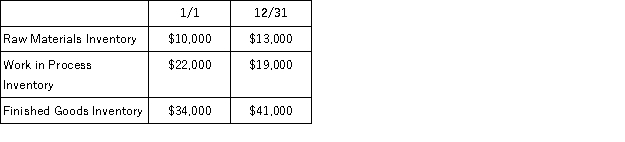

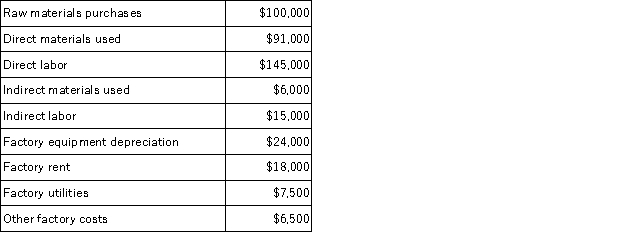

Curtis Inc. uses a job order costing system. Manufacturing overhead is applied on the basis of direct labor cost. Total manufacturing overhead was estimated to be $75,000 for the year; direct labor was estimated to total $150,000.  The following transactions have occurred during the year.

The following transactions have occurred during the year.  a. Calculate the predetermined overhead rate.

a. Calculate the predetermined overhead rate.

b. Calculate cost of goods manufactured.

c. Calculate the over- or underapplied overhead.

d. Calculate adjusted cost of goods sold.

Correct Answer:

Verified

Q93: The current manufacturing costs include _ direct

Q100: Ragtime Company had the following information for

Q101: Which of the following is incorrect regarding

Q105: Deer Lake Inc. uses a job order

Q106: Nashville Inc. uses a job order costing

Q108: Miller Park Inc. uses a job order

Q116: Blueberry Corp.uses a job order costing system

Q117: Chloe Corp.uses a job order costing system

Q118: Optimum Finance Inc.provides budget,savings,and investment services to

Q119: Optimum Finance Inc.provides budget,savings,and investment services to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents