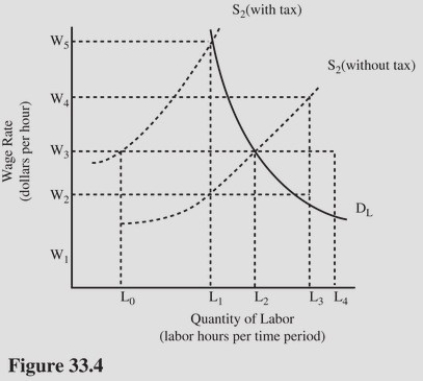

In Figure 33.4,what is the burden of the tax on employers?

In Figure 33.4,what is the burden of the tax on employers?

A) The wage increase of W5 - W3.

B) The wage increase of W5 - W2.

C) The wage increase of W3 - W2.

D) The wage increase of W5 - W1.

Correct Answer:

Verified

Q104: The argument against greater equality in the

Q105: Q106: Which of the following is an example Q107: A flat tax Q108: A flat tax Q110: Greater equality in income is supported by Q111: Since the current tax system is fairly Q112: Which of the following is an example Q113: The U.S.tax system as a whole is Q114: Flat tax critics![]()

A)Encourages economic activity through deductions

A)Includes many tax loopholes.

B)Is a

A)Object to the elimination of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents