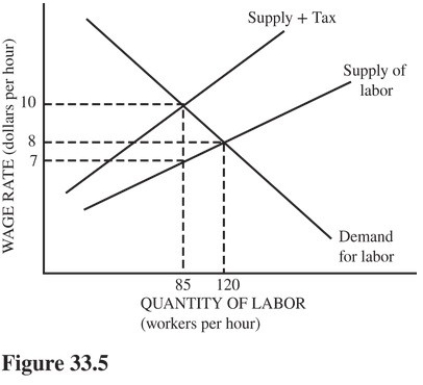

Refer to the labor market in Figure 33.5.Suppose the government imposes a payroll tax on employers.How much of the tax burden is passed on to workers?

Refer to the labor market in Figure 33.5.Suppose the government imposes a payroll tax on employers.How much of the tax burden is passed on to workers?

A) $10 - $8 = $2 per hour.

B) $10 - $7 = $3 per hour.

C) $8 - $7 = $1 per hour.

D) $7 per hour.

Correct Answer:

Verified

Q110: Greater equality in income is supported by

Q111: Since the current tax system is fairly

Q112: Which of the following is an example

Q113: The U.S.tax system as a whole is

Q114: Flat tax critics

A)Object to the elimination of

Q116: The marginal revenue product (MRP)establishes

A)An upper limit

Q117: A flat tax is

A)A tax system in

Q118: Government failure

A)Occurs whenever the government intervenes in

Q119: Q120: ![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents