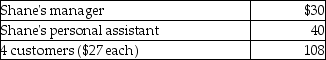

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $125

B) $150

C) $75

D) $178

Correct Answer:

Verified

Q29: If an employee incurs travel expenditures and

Q34: An employer adopts a per diem policy

Q43: If an employee incurs business-related entertainment expenses

Q45: A tax adviser takes a client to

Q47: "Associated with" entertainment expenditures generally must occur

Q52: Rita,a single employee with AGI of $100,000

Q53: Self-employed individuals receive a for AGI deduction

Q54: Clarissa is a very successful real estate

Q58: Matt is a sales representative for a

Q59: An accountant takes her client to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents