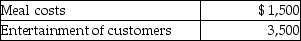

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

A) $500 from AGI

B) $500 for AGI

C) $2,000 from AGI

D) $2,000 for AGI

Correct Answer:

Verified

Q21: Taxpayers may use the standard mileage rate

Q22: Transportation expenses incurred to travel from one

Q24: What factors are considered in determining whether

Q36: Gwen traveled to New York City on

Q37: A taxpayer goes out of town to

Q38: Richard traveled from New Orleans to New

Q42: Joe is a self-employed tax attorney who

Q44: Austin incurs $3,600 for business meals while

Q55: Generally,50% of the cost of business gifts

Q56: Pat is a sales representative for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents