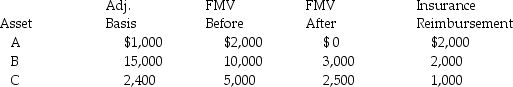

Wes owned a business which was destroyed by fire in May 2016.Details of his losses follow:

His AGI without consideration of the casualty is $45,000.

His AGI without consideration of the casualty is $45,000.

What is Wes's net casualty loss deduction for 2016?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: A taxpayer uses an allowance method (i.e.,aging

Q82: Lisa loans her friend,Grace,$10,000 to finance a

Q86: Taj operates a sole proprietorship,maintaining the business

Q90: In February 2016,Amelia's home,which originally cost $150,000,is

Q93: For a bad debt to be deductible,the

Q94: No deduction is allowed for a partially

Q95: A taxpayer guarantees another person's obligation and

Q95: Constance,who is single,is in an automobile accident

Q96: Determine the net deductible casualty loss on

Q205: A taxpayer suffers a casualty loss on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents