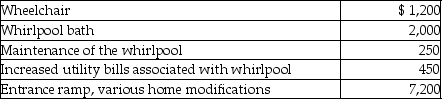

Alan,who is a security officer,is shot while on the job.As a result,Alan suffers from a chronic leg injury and must use a wheelchair and undergo therapy to regain and retain strength.Alan's physician recommends that he install a whirlpool bath in his home for therapy.During the year,Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

A) $6,000.

B) $10,100.

C) $7,000.

D) $7,700.

Correct Answer:

Verified

Q7: If a prepayment is a requirement for

Q13: In order for a taxpayer to deduct

Q14: Expenditures for long-term care insurance premiums qualify

Q17: The definition of medical care includes preventative

Q20: Expenditures incurred in removing structural barriers in

Q31: The following taxes are deductible as itemized

Q39: Foreign real property taxes and foreign income

Q266: Explain under what circumstances meals and lodging

Q270: Discuss the timing of the allowable medical

Q276: Patrick and Belinda have a twelve- year-

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents