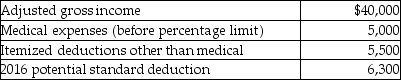

A review of the 2016 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2016 tax status:  In 2017,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2017,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

A) include $200 in gross income for 2017.

B) include $1,200 in gross income for 2017.

C) reduce 2017's medical expenses by $1,200.

D) amend the 2016 return.

Correct Answer:

Verified

Q24: Self-employed individuals may deduct the full self-employment

Q28: Assessments made against real estate for the

Q29: A personal property tax based on the

Q29: Mitzi's medical expenses include the following:

Q30: Linda had a swimming pool constructed at

Q33: Mr.and Mrs.Thibodeaux (both age 35),who are filing

Q36: Matt paid the following taxes this year:

Q37: Arun paid the following taxes this year:

Q38: Assessments or fees imposed by the government

Q280: Explain when the cost of living in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents