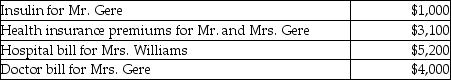

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

A) $5,200

B) $8,300

C) $4,300

D) $13,300

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q30: Linda had a swimming pool constructed at

Q36: Matt paid the following taxes this year:

Q37: Arun paid the following taxes this year:

Q38: Assessments or fees imposed by the government

Q40: Caleb's medical expenses before reimbursement for the

Q41: Finance charges on personal credit cards are

Q44: During the current year,Deborah Baronne,a single individual,paid

Q51: Hui pays self-employment tax on her sole

Q284: Discuss what circumstances must be met for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents