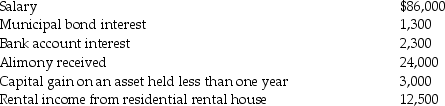

During the current year,Donna,a single taxpayer,reports the following items income of income and expenses:

Income:

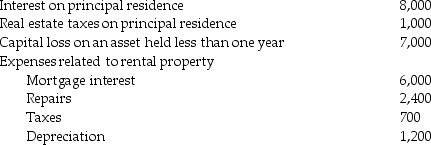

Expenses/losses:

Expenses/losses:

Compute Donna's taxable income.(Show all calculations in good form. )

Compute Donna's taxable income.(Show all calculations in good form. )

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Assume Congress wishes to encourage healthy eating

Q12: Deductions for AGI may be located

A)on the

Q20: Individuals are allowed to deduct the greater

Q22: Leigh pays the following legal and accounting

Q22: Laura,the controlling shareholder and an employee of

Q25: During the current year,Martin purchases undeveloped land

Q26: Maria pays the following legal and accounting

Q27: To be tax deductible,an expense must be

Q28: In order for an expense to be

Q401: List those criteria necessary for an expenditure

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents