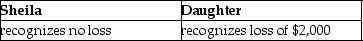

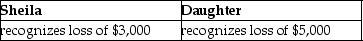

Sheila sells stock,which has a basis of $12,000,to her daughter for $7,000,the stock's fair market value.Subsequently,the daughter sells the stock to an unrelated party for $5,000.Which of the following is true for the Sheila and the Daughter?

A)

B)

C)

D)

Correct Answer:

Verified

Q83: The vacation home limitations of Section 280A

Q96: If property that qualifies as a taxpayer's

Q97: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q98: Expenses related to a hobby are deductible

Q101: Donald sells stock with an adjusted basis

Q104: Expenses attributable to the rental use of

Q110: Rob sells stock with a cost of

Q115: Jason sells stock with an adjusted basis

Q117: Chana purchased 400 shares of Tronco Corporation

Q118: For the years 2012 through 2016 (inclusive)Max,a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents