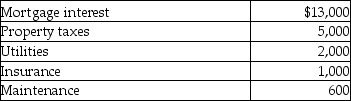

Ola owns a cottage at the beach.She and her family use the property for 30 days during the summer season and rent it to unrelated parties for 60 days.The rental receipts amount to $8,000.Total costs of operating the property are as follows:

In addition,potential depreciation expense is $9,000.

In addition,potential depreciation expense is $9,000.

a.Is the cottage subject to the vacation home rental limitations of IRC Sec.280A?

b.How much of expenses can Ola deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Nikki is a single taxpayer who owns

Q108: The Super Bowl is played in Tasha's

Q127: Lloyd purchased 100 shares of Gold Corporation

Q128: Vanessa owns a houseboat on Lake Las

Q129: During the current year,Paul,a single taxpayer,reported the

Q131: Margaret,a single taxpayer,operates a small pottery activity

Q136: Abby owns a condominium in the Great

Q138: Lindsey Forbes,a detective who is single,operates a

Q483: During the current year, Jack personally uses

Q486: Explain the rules for determining whether a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents