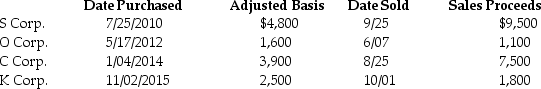

Mike sold the following shares of stock in 2016:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Q88: Candice owns a mutual fund that reinvests

Q101: Trista,a taxpayer in the 33% marginal tax

Q103: Niral is single and provides you with

Q104: Jade is a single taxpayer in the

Q107: During the current year,Nancy had the following

Q108: Gertie has a NSTCL of $9,000 and

Q110: Corporate taxpayers may offset capital losses only

Q111: Chen had the following capital asset transactions

Q118: Maya expects to report about $2 million

Q118: Abra Corporation generated $100,000 of taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents