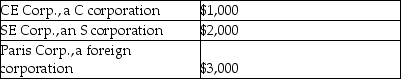

Natasha is a single taxpayer with a 28% marginal tax rate.She received distributions of earnings this year as follows:  How much of the $6,000 distribution will be taxed at the 15% tax rate?

How much of the $6,000 distribution will be taxed at the 15% tax rate?

A) $0

B) $1,000

C) $3,000

D) $6,000

Correct Answer:

Verified

Q61: Which of the following is not included

Q64: Distributions from corporations to the shareholders in

Q68: Tyler has rented a house from Camarah

Q83: Child support is

A)deductible by both the payor

Q84: In 2016,Richard,a single taxpayer,has adjusted gross income

Q86: Tarik,a single taxpayer,has AGI of $55,000 which

Q87: The requirements for a payment to be

Q90: Alimony is

A)deductible by both the payor and

Q97: Julia owns 1,000 shares of Orange Corporation.This

Q99: Which of the following is least likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents