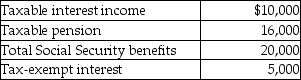

Mr.& Mrs.Tsayong are both over 66 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

A) $0

B) $4,500

C) $10,000

D) $20,000

Correct Answer:

Verified

Q100: Thomas purchased an annuity for $20,000 that

Q104: Reva is a single taxpayer with a

Q105: While using a metal detector at the

Q107: Homer Corporation's office building was destroyed by

Q108: Lily had the following income and losses

Q110: Lori had the following income and losses

Q112: Jan purchased an antique desk at auction.For

Q117: Insurance proceeds received because of the destruction

Q117: During 2015,Christiana's employer withheld $1,500 from her

Q120: The term "Social Security benefits" does not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents