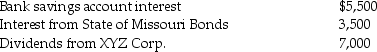

Kevin is a single person who earns $70,000 in salary for 2016 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2015 tax returns in April 2016.His federal refund was $600 and his state refund was $300.Kevin deducted his stated taxes paid in 2015 as an itemized deduction on his 2015 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2016 return.

Kevin received tax refunds when he filed his 2015 tax returns in April 2016.His federal refund was $600 and his state refund was $300.Kevin deducted his stated taxes paid in 2015 as an itemized deduction on his 2015 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2016 return.

Compute Kevin's taxable income for 2016.

Correct Answer:

Verified

Q113: An electrician completes a rewiring job and

Q121: "Gross income" is a key term in

Q125: Edward is considering returning to work part-time

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Q131: Daniel plans to invest $20,000 in either

Q133: Leigh inherited $65,000 of City of New

Q134: Marisa and Kurt divorced in 2014.Under the

Q139: On April 1,2016,Martha,age 67,begins receiving payments of

Q141: While certain income of a minor is

Q911: Marcia and Dave are separated and negotiating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents