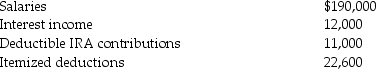

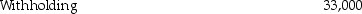

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2016.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Q2: All of the following items are deductions

Q6: Generally,itemized deductions are personal expenses specifically allowed

Q9: Generally,deductions for (not from)adjusted gross income are

Q9: Which of the following credits is considered

Q10: Although exclusions are usually not reported on

Q10: Bill and Tessa have two children whom

Q12: A single taxpayer provided the following information

Q12: Nonrefundable tax credits are allowed to reduce

Q16: All of the following items are deductions

Q18: Kadeisha is single with no dependents and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents