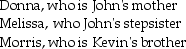

John supports Kevin,his cousin,who lived with him throughout 2016.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $4,050.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $4,050.How many personal and dependency exemptions may John claim?

A) 2

B) 3

C) 4

D) 5

Correct Answer:

Verified

Q46: An unmarried taxpayer may file as head

Q51: Sarah,who is single,maintains a home in which

Q52: Amber supports four individuals: Erin,her stepdaughter,who lives

Q54: Which of the following is not considered

Q55: Cheryl is claimed as a dependent on

Q57: A married person who files a separate

Q62: Ryan and Edith file a joint return

Q63: Foreign exchange student Yung lives with Harold

Q64: For each of the following independent cases,indicate

Q67: A widow or widower may file a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents