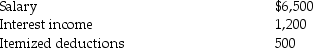

The following information for 2015 relates to Emma Grace,a single taxpayer,age 18:

a.Compute Emma Grace's taxable income assuming she is self-supporting.

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Q82: A $10,000 gain earned on stock held

Q97: The annual tax reporting form filed with

Q106: Married couples will normally file jointly.Identify a

Q115: Keith,age 17,is a dependent of his parents.During

Q116: Vincent,age 12,is a dependent of his parents.During

Q119: Indicate for each of the following the

Q121: Charishma is a taxpayer with taxable income

Q122: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is

Q125: Avi and Rianna are considering marriage before

Q135: If an individual with a marginal tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents