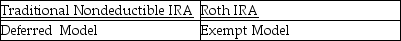

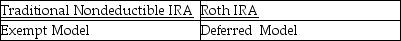

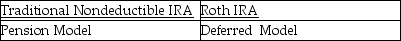

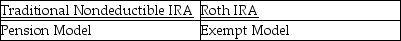

Taxpayers often have to decide between contributing to a traditional nondeductible IRA or a Roth IRA.In making the comparison between the two IRAs,which models should the taxpayer use?

A)

B)

C)

D)

Correct Answer:

Verified

Q43: Will invests $20,000 of after-tax dollars (AT$)in

Q47: Which of the following characteristics belong(s)to the

Q48: If t0 is the tax rate in

Q52: The Pension Model has all of the

Q53: Brianna purchases stock for $8,000.The stock appreciates

Q58: Ken invests $10,000 in a deductible IRA

Q1082: Compare the characteristics of the Current and

Q1092: Rachel invests $5,000 in a money market

Q1095: Cooper can invest $10,000 after- tax dollars

Q1099: What are the characteristics of the Pension

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents