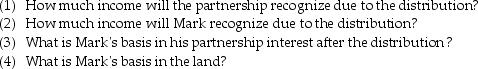

Mark receives a nonliquidating distribution of $10,000 cash and a parcel of land having an adjusted basis of $18,000 and a fair market value of $25,000.

a.Mark's basis in his partnership interest prior to the distribution is $50,000.

b.Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

b.Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

Correct Answer:

Verified

Q85: Which of the following is not a

Q91: Longhorn Partnership reports the following items at

Q92: The AAA Partnership makes an election to

Q96: Torrie and Laura form a partnership in

Q96: Which of the following assets may cause

Q98: Oliver receives a nonliquidating distribution of land

Q112: All of the following are requirements to

Q1203: Elise contributes property having a $60,000 FMV

Q1210: At the beginning of this year, Thomas

Q1225: Explain the difference between expenses of organizing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents