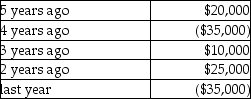

For this tax year,Madison Corporation had taxable income of $80,000 before using any of the net operating loss from the previous year.Madison has never elected to forgo the carryback of its losses since incorporation five years ago.Madison's books and records reflect the following income (loss) since its incorporation.  What amount of taxable income (loss) should Madison report on its current tax return?

What amount of taxable income (loss) should Madison report on its current tax return?

A) $45,000

B) $65,000

C) $70,000

D) $80,000

Correct Answer:

Verified

Q21: Identify which of the following statements is

Q23: If a corporation's charitable contributions exceed the

Q24: June Corporation has the following income and

Q25: A corporation has the following capital gains

Q26: Montage Corporation has the following income and

Q29: Louisiana Land Corporation reported the following results

Q30: Musketeer Corporation has the following income and

Q32: Witte Corporation reported the following results for

Q36: A U.S.-based corporation produces cereal in Niagara

Q50: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents