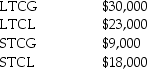

Small Corporation had the following capital gains and losses during the current year:

Taxable income,exclusive of the capital gains and losses above,is $68,000.

Taxable income,exclusive of the capital gains and losses above,is $68,000.

a.How should the capital gains and losses be treated for the current year?

b.What is the taxable income for the current year taking into consideration the capital gains and losses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: For purposes of the accumulated earnings tax,reasonable

Q43: A controlled group of corporations must apportion

Q48: One requirement of a personal holding company

Q50: For purposes of the accumulated earnings tax,reasonable

Q53: DEF Corporation and MNO Corporation are both

Q54: The accumulated earnings tax is imposed on

Q56: Concepts Corporation reported the following results for

Q56: The corporate AMT rate is 26% on

Q58: Indicators of possible exposure of accumulated earning

Q75: Montrose Corporation is classified as a personal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents