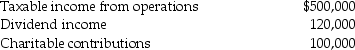

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly-traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly-traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: For purposes of the accumulated earnings tax,reasonable

Q43: A controlled group of corporations must apportion

Q46: Oak Corporation manufactures widgets in its factory

Q48: One requirement of a personal holding company

Q50: For purposes of the accumulated earnings tax,reasonable

Q53: DEF Corporation and MNO Corporation are both

Q54: The accumulated earnings tax is imposed on

Q56: The corporate AMT rate is 26% on

Q58: Small Corporation had the following capital gains

Q60: The purpose of the accumulated earnings tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents