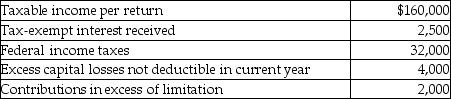

Greg Corporation,an accrual method taxpayer,had accumulated earnings and profits of $300,000 as of December 31,last year.For its current tax year,Greg's books and records reflect the following:  Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

A) $120,500

B) $122,000

C) $124,500

D) $129,500

Correct Answer:

Verified

Q26: Dixie Corporation distributes $31,000 to its sole

Q64: Peter transfers an office building into a

Q65: If certain requirements are met,Sec.351 permits deferral

Q86: Slimtin Corporation has $400,000 of regular taxable

Q87: A corporation earns $500,000 of current E&P

Q94: Blue Corporation distributes land and building having

Q97: Bob transfers assets with a $100,000 FMV

Q116: Individuals Jimmy and Ellen form JE Corporation.Ellen

Q119: Total Corporation has earned $75,000 current E&P

Q1378: Atlantic Corporation, a calendar- year taxpayer, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents