A corporation distributes land worth $200,000 to its sole shareholder.The corporation had purchased the land several years ago for $120,000.The corporation has over $1 million of E&P.How much income will the corporation and the shareholder recognize?

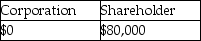

A)

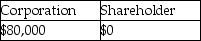

B)

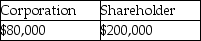

C)

D)

Correct Answer:

Verified

Q91: If a corporation has no E&P,a distribution

Q96: A corporation redeems 10 percent of the

Q99: A calendar-year corporation has a $15,000 current

Q107: A corporation distributes land with a FMV

Q108: How does the treatment of a liquidation

Q111: A closely held corporation will generally prefer

Q123: Lafayette Corporation distributes $80,000 in cash along

Q125: Star Corporation,in complete liquidation,makes distributions to its

Q127: A liquidating corporation

A)recognizes gains and losses on

Q1394: Discuss the tax consequences of a complete

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents