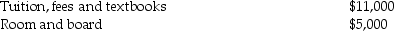

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2016:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Runway Corporation has $2 million of gross

Q101: Sam and Megan are married with two

Q101: To help retain its talented workforce,Zapper Corporation

Q105: A taxpayer will be ineligible for the

Q108: Individuals without children are eligible for the

Q111: Which of the following expenditures will qualify

Q111: Tyler and Molly,who are married filing jointly

Q113: Dwayne has general business credits totaling $30,000

Q119: Layla earned $20,000 of general business credits

Q120: ChocoHealth Inc.is developing new chocolate products providing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents