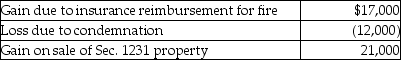

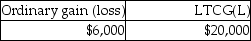

This year Pranav had the gains and losses noted below on property,plant and equipment used in his business.Each asset had been held longer than one year.  A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

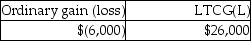

A)

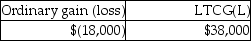

B)

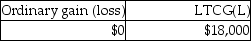

C)

D)

Correct Answer:

Verified

Q42: Sec.1245 can increase the amount of gain

Q43: Sec.1245 ordinary income recapture can apply to

Q51: The amount recaptured as ordinary income under

Q53: The following are gains and losses recognized

Q54: Section 1245 recapture applies to all the

Q56: This year Jenna had the gains and

Q59: During the current year,Hugo sells equipment for

Q59: All of the following statements are true

Q62: Network Corporation purchased $200,000 of five-year equipment

Q75: With regard to noncorporate taxpayers,all of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents