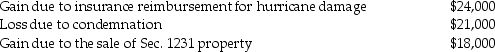

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Gains and losses resulting from condemnations of

Q15: Gains and losses from involuntary conversions of

Q30: A corporation owns many acres of timber,which

Q36: Elaine owns equipment ($23,000 basis and $15,000

Q45: Terry has sold equipment used in her

Q47: A taxpayer has a gain on Sec.1245

Q47: The following gains and losses pertain to

Q48: During the current year,a corporation sells equipment

Q49: Sec.1245 applies to gains on the sale

Q54: A taxpayer acquired new machinery costing $50,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents