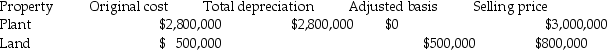

Julie sells her manufacturing plant and land originally purchased in 1980.Accelerated depreciation had been taken on the building,but the building is now fully depreciated.Julie is in the 39.6% marginal tax bracket.Other information is as follows:

She has not sold any other assets this year.A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year.What are the tax consequences of the sale (type of gain;rates at which taxed)?

She has not sold any other assets this year.A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year.What are the tax consequences of the sale (type of gain;rates at which taxed)?

Correct Answer:

Verified

Q65: When appreciated property is transferred at death,the

Q66: Trena LLC,a tax partnership owned equally by

Q68: When a donee disposes of appreciated gift

Q77: Gifts of appreciated depreciable property may trigger

Q86: Connors Corporation sold a warehouse during the

Q87: When gain is recognized on an involuntary

Q89: A corporation sold a warehouse during the

Q90: WAM Corporation sold a warehouse during the

Q92: Pam owns a building used in her

Q93: If no gain is recognized in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents