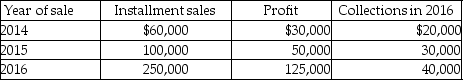

Freida is an accrual-basis taxpayer who owns a furniture store.The furniture store had the following sales of inventory:  For tax purposes,Freida should report gross profit for 2016 of

For tax purposes,Freida should report gross profit for 2016 of

A) $40,000.

B) $65,000.

C) $90,000.

D) $125,000.

Correct Answer:

Verified

Q48: When accounting for long-term contracts (other than

Q54: Contracts for services including accounting,legal and architectural

Q58: For tax purposes,"market" for purposes of applying

Q59: CPA Associates,a cash basis partnership with a

Q60: Which of the following statements regarding UNICAP

Q65: In year 1 a contractor agrees to

Q66: The installment method may be used for

Q66: A taxpayer must use the same accounting

Q67: This year,a contractor agrees to build a

Q72: Which of the following conditions are required

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents