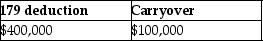

Caitlyn purchases and places in service property costing $450,000 in 2016.She wants to elect the maximum Sec.179 deduction allowed.The property does not qualify for bonus depreciation.Her business income is $400,000.What is the amount of her allowable Sec.179 deduction and carryover,if any?

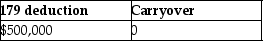

A)

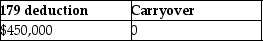

B)

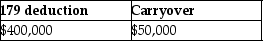

C)

D)

Correct Answer:

Verified

Q24: The mid-quarter convention applies to personal and

Q26: Under the MACRS system,the same convention that

Q40: If a new luxury automobile is used

Q41: Ilene owns an unincorporated manufacturing business.In 2016,she

Q42: Harrison acquires $65,000 of 5-year property in

Q44: On August 11,2016,Nancy acquired and placed into

Q45: Fariq purchases and places in service in

Q46: Paul bought a computer for $15,000 for

Q47: Sophie owns an unincorporated manufacturing business.In 2016,she

Q49: For real property placed in service after

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents