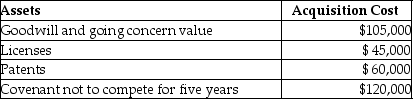

On January 1,2016,Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000.The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2016?

What is the total amount of amortization allowed in 2016?

A) $15,000

B) $22,000

C) $31,000

D) $38,000

Correct Answer:

Verified

Q62: Galaxy Corporation purchases specialty software from a

Q66: Costs that qualify as research and experimental

Q71: Most taxpayers elect to expense R&E expenditures

Q77: Everest Corp.acquires a machine (seven-year property)on January

Q78: On May 1,2012,Empire Properties Corp. ,a calendar

Q79: Arthur uses a Chevrolet Suburban (GVWR 7,500

Q88: In accounting for research and experimental expenditures,all

Q2094: Jack purchases land which he plans on

Q2119: Why would a taxpayer elect to capitalize

Q2138: Why would a taxpayer elect to use

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents